by Peter Aitken

World banking institutions and experts have labeled China's approach as 'unsustainable'

China’s economic rebound may face a greater uphill battle than Beijing would otherwise like the world to believe thanks to pressure within the real estate sector and "frustrations" in the banking industry.

"China's economy has been slowing for quite some time," Craig Singleton, a fellow at the nonpartisan Foundation for Defense of Democracies, told Fox News Digital. "What we're witnessing now is a rapid economic slowdown."

Economists can’t seem to make heads or tails of China’s current economic situation: GDP data indicated a sharp slowdown in Q2, but just weeks ago the Hang Seng hit a 3-month high in what some analysts hailed as signs of recovery.

Larry Hu, the chief Chinese economist at Macquarie in Australia, told Fortune that the economy "is on the mend, but it remains very weak." He attributed the struggles to the impact of extended lockdowns during the pandemic, and China’s zero-covid policy has only further complicated the issue.

REP. WALZT SAYS CHINA ‘BUYING UP’ AMERICAN LAND, RESOURCES: THIS IS AN ‘ECONOMIC WAR’

The policy requires localized lockdowns with the detection of any COVID-19 infections, which has led to the prolonged lockdown of major ports and economic centers. Shanghai shut down for 60 days in Spring 2022, measuring a peak of 26,000 cases per day in April. Post-lockdown, officials reported only 29 cases on June 1.

|

FILE PHOTO: Under-construction apartments are pictured from a building during sunset in the Shekou area of Shenzhen, Guangdong province, China November 7, 2021. (Reuters/David Kirton) |

Singleton argues that while COVID has played a part in the initial troubles, China’s recovery slowdown has resulted from "deeper structural, systemic problems."

"One of them happens to be … China's hyper leveraged property market by some conservative estimates," he explained. "China's property sector makes up 30% of Chinese GDP, so even small deviations in that market can have outsized impact on China's broader global domestic product and its broader growth."

Homebuyers across China have threatened to stop making mortgage payments, blaming "stalled" building work, which has added a serious wrinkle against any recovery Beijing has recorded.

"We've seen a number of very large defaults of some of the largest Chinese property construction companies," Singleton said. "We've seen an increasing amount of frustration from Chinese citizens who have sunk their life savings into China's real estate market, primarily viewing it as an investment vehicle or a safe investment, and now many of them are left unable to move into their homes."

The China Banking and Insurance Regulatory Commission (CBIRC) insisted that the banks should meet "reasonable" developer financing needs and that "all the difficulties and problems will be properly solved," Reuters reported. Data for the property sector showed a 7% shrink in the second quarter compared to the previous year.

Chinese Premier Li Keqiang spoke with 100,000 officials to lay out a 33-point plan that included a $120 billion credit line for infrastructure projects. The World Bank voiced concern that Beijing would turn to "the old playbook of boosting growth through debt-financed infrastructure and real estate investment."

"Such a growth model is ultimately unsustainable, and the indebtedness of many corporates and local governments is already too high," the World Bank wrote, instead supporting consumer-based incentives.

CHINA WARNS OF ‘FORCEFUL MEASURES’ IF US HOUSE SPEAKER PELOSI VISITS TAIWAN

That economic weakness creates a troubling picture for Chinese President Xi Jinping as he seeks another, record third term as leader, according to Asia expert and Gatestone Institute senior fellow Gordon Chang. Xi might try to shake things up in order to show that China remains strong internationally even as it faces these domestic troubles.

"Xi Jinping has every incentive in the world to cause some military misadventure abroad," Chang said, saying Xi could "either invade a neighbor or perhaps dangerously intercept a plane or a vessel."

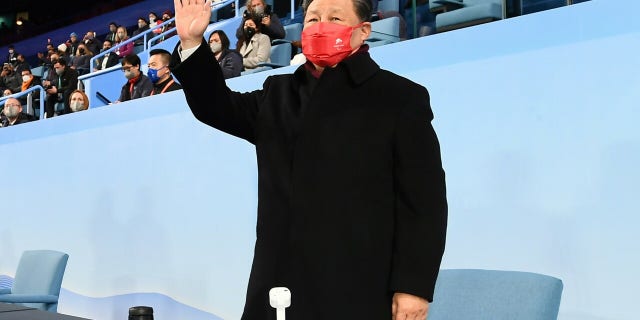

Chinese President Xi Jinping waves during the closing ceremony of the Beijing 2022 Paralympic Winter Games at the National Stadium in Beijing, capital of China, March 13, 2022. (Photo by Xie Huanchi/Xinhua via Getty Images)

"We don’t know exactly what he would do, but he does have reason to do it," Chang added. "Right now, China is in distress: [Xi]'s got the mortgage boycott, which is now in 86 cities; a new supplier’s boycott; bank runs - this is just unprecedented."

Chang suggested Xi might try to even stir up trouble with India, a neighbor that China has clashed with a number of times over recent years. He also pointed to recent Chinese incursions into Japanese waters, as well as renewed pressure in the South China Sea, which prompted a warning from the U.S. State Department.

HALEY OPPOSES MAJOR COMPUTER CHIPS BILL: ‘WE DON’T NEED TO BE CHINA TO BEAT CHINA'

"We know that these are not only simmering incidents, but some of them could actually make sure to a full-blown crisis," he said.

The Center for Strategic and International Studies wrote that Zero-Covid has "exacted high economic, social and political costs in a remarkably short period." Analysts at the Center believe that the policy has "disrupted manufacturing, supply chains and consumer spending."

Singleton noted that this has led to record-high urban youth unemployment and "broad-based" frustration in the banking sector. About one-fifth of all 16 to 24-year-olds in China are currently unemployed, meaning less than 15% of recent graduates have managed to find jobs.

"There's every indication that China will fall far short of meeting its annual economic growth target of 5.5%," Singleton argued. "What we are starting to realize very quickly, I think, is that, you know, the days of China's meteoric economic, economic rise are long past."

Peter Aitken is a Fox News Digital reporter with a focus on national and global news.

Source: https://www.foxnews.com/world/chinas-economy-suffering-rapid-slowdown-systemic-problems-surface